2,934 hours

By Joanna Levitt Cea, Former Director of Buen Vivir Fund (an investment fund that thrived from 2018-2023) (En español aquí)

81 people spent 2,934 hours to do it.

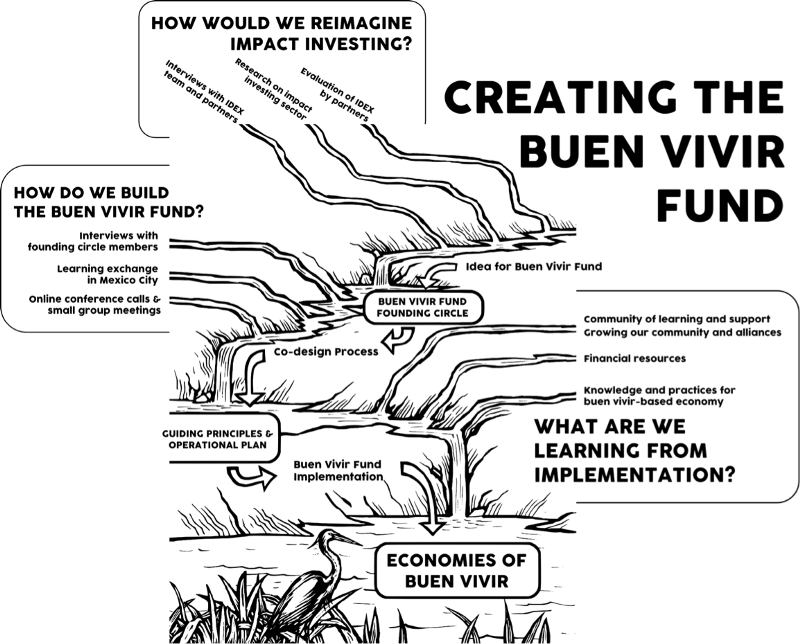

This is the ethos that we embraced one year ago, upon initiating the design of the Buen Vivir Fund. As more and more foundations and people of wealth took notice of impact investing, we at Thousand Currents saw a major gap. People wanted to help solve issues of poverty and inequality, not uphold the current economic system with their investment dollars.

But the opportunities were often still based on old economic principles, and were falling into the same trap as more traditional philanthropy and international aid — not listening to what people really wanted — at either the grassroots level nor on the part of investors.

“Here’s a new tech gadget that will help farmers to…”

“Invest in this new company. It’s creating jobs in the Global South.”

“Help scale up microfinance.”

On all sides, we were finding people who were hungry for something profoundly different, something that enabled them to bring their whole selves to the task of investing in a better world. Investors wanted to be more than “an ATM machine.” Grassroots leaders in the Global South, who for decades have been working around financial systems that don’t serve them, wanted to build upon the successful new economy practices they had developed or pre-colonial practices they fought to keep, and bring that wisdom to bear on a larger scale.

The field of impact investing has grown wide over the past decade, but we at Thousand Currents knew that if we could work together with our partners, we could co-create an alternative approach that didn’t perpetuate systems of extraction and exploitation:

- What if the investors weren’t the ones dictating the terms of investment?

- What if investments didn’t extract resources from the earth and instead upheld human rights, food sovereignty and climate justice?

- What if we could create an investment fund where a community in Oaxaca that wanted to install a solar electric system could get the US$50,000 they need and know that their community’s decision-making processes and ways of life would not be disrupted in the process? Or the community in Rajasthan that wanted to restore soil health and launch a organic farming initiative could access the $75,000 they need and know the timeframe, terms, and return would be aligned with the seasons and cycles of their unique agro-ecological systems?

- What if returns were defined in ways that not only went beyond financial terms, but also beyond the usual “social and environmental returns” measured by mainstream impact funds? What if we actually measured and valued other forms of return vital to building a world of well-being and balance, such as:

- The quality of time we have to spend with family and community;

- A reduction in fear and anxiety from pressure-filled financial demands that makes sense for profiteering but not for people and planet; and

- A strengthened sense of connection with the natural world and spirit, and the ways it sustains us and our community?

These questions, and more, are what drove 81 people from six countries, with vastly different economic experiences in their lives, to spend 2,934 hours together, planning, dreaming, discussing, disagreeing, and consulting, both in person last October, and also in virtual meetings via video-conference, often at odd hours of the day.

Morgan Simon, Pi Investments and Libra Foundation

“Investors need to know that alternatives exist, and be invited into those spaces,” says Morgan Simon of Pi Investments and Libra Foundation.

We invested the time together because we were not creating a one-size-fits-all investment model, we were creating a model process for deeper impact. We had to determine what kinds of exchanges and agreements would be life giving rather than resource amassing.

Jorge Santiago, Desarrollo Económico y Social de los Mexicanos Indígenas Social Economic Development of Indigenous Mexicans (DESMI)

As Don Jorge Santiago, former staff and current adviser to DESMI, asked us often during the last year: “How do we escape the trap that comes with money? And that is: control, power.”

Pulling together a diversity of ideas and experiences from six different countries takes time, but why did it take 2,934 hours to come up with the design for how this new investment fund will work? As our Thousand Currents board member Nwamaka Agbo explains,

Nwamaka Agbo, Next Economy Fellow at the Movement Strategy Center and Thousand Currents board member

“The deep work of unlearning the habits and patterns of colonization, of a harmful, extractive economy, is really difficult work.

“And it’s difficult work because it’s embedded in our soul, it’s in our being.”

It was indeed hard work. It required all of us to make time amidst all that we have on our plates; to be brave in sharing frankly about our life experiences related to wealth and investment, even if those questions bring up feelings of pain or shame; and to push ourselves to question even our most fundamental assumptions about how money can be shared and utilized.

Plus — at the same time, we all carried an acute awareness with us that the Buen Vivir Fund we design needs to demonstrate to the world that we are not messing around. This is not a dreamy, feel-good fund for a few very liberal people’s charitable time and money. No. This needs to be a powerful new model that shows that investment practice based on placing our well-being and interconnection at the center actually works. The numbers add up. The Fund can achieve the returns we aim for. The financial, governance, and due diligence practices that we utilize not only feel better — they aim for higher impact.

Last week we took an enormous first step to that end. The Members Assembly of the Buen Vivir Fund approved the Guiding Framework document that brings together the key decisions we have made together over the past year. This will govern how the Buen Vivir Fund works — how all the investment policies and tools and protocols come together.

These 81 people who spent 2,934 hours — including staff of the 18 member organizations of the Buen vivir Fund’s founding circle, plus “ally-advisers” who are sharing their experience and guidance, and community members and board members of the founding circle groups (and this figure doesn’t even include Thousand Currents staff hours) — have built the trust, the systems, the tolerance for risk, and the excitement to launch this first cycle of investment and learning.

There is much to celebrate with this milestone! And we also recognize that the proof begins now.

We are so honored and excited to be on this journey with our partners. Our partners frequently remind us that embracing buen vivir means not only trying to reach a distant destination of a utopian world of buen vivir, but it also means committing here and now to being on the road of buen vivir — with joy, caring for our own and one another’s well-being, and continually cultivating an awareness of the very tangible ways we are interconnected. In other words, the process is inseparable from the destination.

Don Javier Inda Andrio, EduPaz

Don Javier Inda Andrio of our partner EduPaz was on his way to spend some time with his 104-year-old father last week. As we approached the finish line of our draft Guiding Framework and were putting the last touches on the application form, Don Javier, who is himself an elder of his organization, made a stop on his bus ride to get to a computer because he cared so much about giving his input for the fund.

When I was awed by this, and expressed my appreciation to him, he simply replied,

“Of course! The Buen Vivir Fund is a new road.”

***

Thank you, members of the Buen Vivir Fund founding circle, for being part of a co-design process that has placed us firmly on the road of buen vivir!

Stay tuned to our announcement later in the year of the first investments by the Buen Vivir Fund!

*This piece originally appeared on Medium.